5.5 Sending an Invoice to a Customer

|

|

To send an invoice to a customer for completed work that

they requested, first go to the list of closed maintenance requests (see

section 5.4 Viewing the List of Closed Maintenance Requests for how

to do this). Then locate the request

for which you want to create an invoice in the list of closed requests:

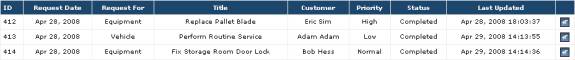

Fig 5.5-1 – List of closed maintenance requests

Once you’ve located the request for which you want to

create an invoice, then look to the right until you find the small ![]() button. Clicking on that

button will take you to the work order which you created for the request. Find the GENERATE INVOICE button at

the bottom of the work order screen:

button. Clicking on that

button will take you to the work order which you created for the request. Find the GENERATE INVOICE button at

the bottom of the work order screen:

![]()

Fig 5.5-2 – “GENERATE INVOICE” button to generate an

invoice from a customer request

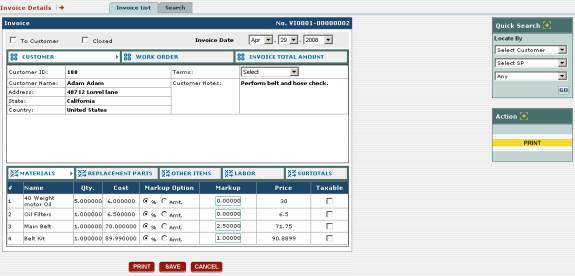

Once you click on the GENERATE INVOICE button, you

will be taken to the following screen where you create the invoice you are

sending to the customer:

Fig 5.5-3 – Screen at which you create an invoice for a

customer

Note: if you

have made a change to the invoice here (such as a markup or the addition of a

tax) and it doesn’t seem to be reflecting on other parts of the invoice, try

clicking on the SAVE button to see if that corrects the problem.

This screen lets you view all of the details for the

invoice you are sending to the customer,

You can view the information for the customer to whom you are sending

the invoice, the details of the work order for the work the customer requested,

and the total costs included in the invoice using the CUSTOMER, WORK

ORDER, and INVOICE TOTAL AMOUNT options respectively:

![]()

Fig 5.5-4 – “CUSTOMER”, “WORK ORDER”, and “INVOICE TOTAL

AMOUNT” options

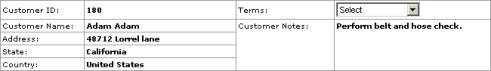

If CUSTOMER is selected, the details for the

customer to whom you are sending the invoice are shown:

Fig 5.5-5 – Details about the customer to whom you are

sending the invoice

You can select the terms of payment from the Terms

drop-down box above the Customer Notes.

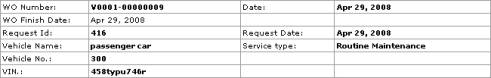

If WORK ORDER is selected, the details of the work

order issued to perform the maintenance requested by the customer are shown:

Fig 5.5-6 – Details about the work order from which the

invoice is being created

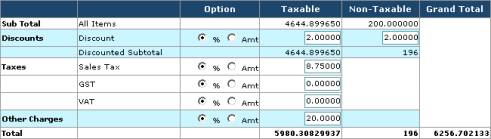

If INVOICE TOTAL AMOUNT is selected, then the total

cost for the work plus materials is shown as well as any discounts, taxes, and

other charges added on:

Fig 5.5-7 – Invoice totals

Here you can apply discounts to the cost of the invoice as

well as taxes and other charges. As you

can see, the discounts to the taxable items on the invoice and the non-taxable

ones are entered separately. You can

then add any sales tax, goods-and-services tax (GST), and value-added tax to

the total cost of the taxable items in the invoice (click in one of the small

circles called % or Amt. to add tax as a percentage or a

particular amount respectively). You

can also enter any other charges either as a percentage or a particular amount.

You can also view the materials, replacement parts, the

other ad hoc items used in the maintenance, as well as the labor costs and all

of the subtotals for these items using the MATERIALS, REPLACEMENT

PARTS, OTHER ITEMS, LABOR, and SUBTOTALS options

respectively:

![]()

Fig 5.5-8 – “MATERIALS”, “REPLACEMENT PARTS”, “OTHER

ITEMS”, “LABOR”, and “SUBTOTALS” options

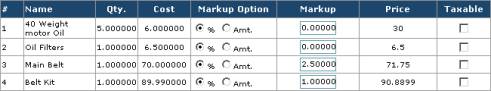

Selecting the MATERIALS option shows you all of the

materials used in the work order:

Fig 5.5-9 – Materials in the invoice

For each material shown in the list the name of the

material is shown along with the quantity that was used and the cost per unit.

You can also mark up each material used in the maintenance

by either a percentage or a particular amount.

Under the Markup Option column, click in one of the small circles

called % or Amt. to markup by a percentage or a particular amount

respectively. Then, depending on what you

selected, type in the percentage or the amount in the appropriate box under the

Markup column. Notice that the

change will be reflected in the amount shown for that item in the Price

column. If you already entered a markup

when you entered the item into your inventory (see section 4.1.2 Inputting Your Inventory Items)

You can also choose which of these materials are taxable

by checking those items’ corresponding boxes under the Taxable

column. Checking the box for an item

means that the tax rate you entered under the Invoice Total Amount

section will be applied to the item.

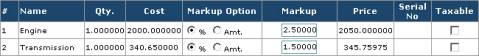

Selecting the REPLACEMENT PARTS option shows you

all of the replacement parts used in the work order:

Fig 5.5-10 – Replacement parts in the invoice

As with the materials, here the name of the replacement

part is shown along with the quantity that was used and the cost per unit. You can also markup the cost of the part if

you’d like and mark it as a taxable item.

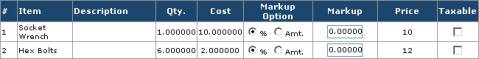

Selecting the OTHER ITEMS option shows you all of

the other ad hoc items on the work order:

Fig 5.5-11 – Other items in the invoice

Again, each item here is shown with the quantity and the

cost, and you can markup each item or mark it as taxable.

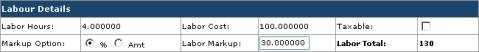

Selecting the LABOR option shows you the details

for the labor costs on the work order: the number of labor hours worked, the

total labor cost, and the markup on the labor:

Fig 5.5-12 – Other items in the invoice

As with previous costs on the invoice, you can also add a

markup to the labor and mark it as taxable.

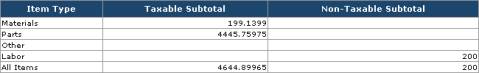

Selecting the SUBTOTALS option shows you all of the

subtotals for the invoice, and breaks each part into the amounts that are

taxable and non-taxable:

Fig 5.5-13 – Subtotals for invoice

Now, to send the invoice to the customer for whom you

performed the work, click on the To Customer checkbox and save the

invoice by clicking on the SAVE button at the upper left. The invoice will now be viewable to the

customer when they log into EZM Web, and they can print the invoice out.